Market Cycle Guidebook - May 2024

Asset class views, macro outlook, long-term expectations, and over 70 charts tracking macro policy, cycle data, and valuations across a global multi-asset universe...

We’ve just published the latest "Market Cycle Guidebook" — one of the main reports in our institutional research service (see details below).

The monthly Market Cycle Guidebook is designed to be a practical & tactical asset allocation guidebook for global multi-asset investors +those who require visibility and insight on the big picture outlook.

It focuses on illuminating the key drivers of risk and return across a global multi-asset universe, with the objective of generating actionable conclusions and meaningful insights for medium-term active asset allocation decisions.

The pack is of particular use to those with a longer-term timeframe, or those who take shorter-term positions but still want a pulse-check on the macro trends and themes that will ultimately filter through to short-term market outcomes.

>> Some of the key takeaways from the latest edition:

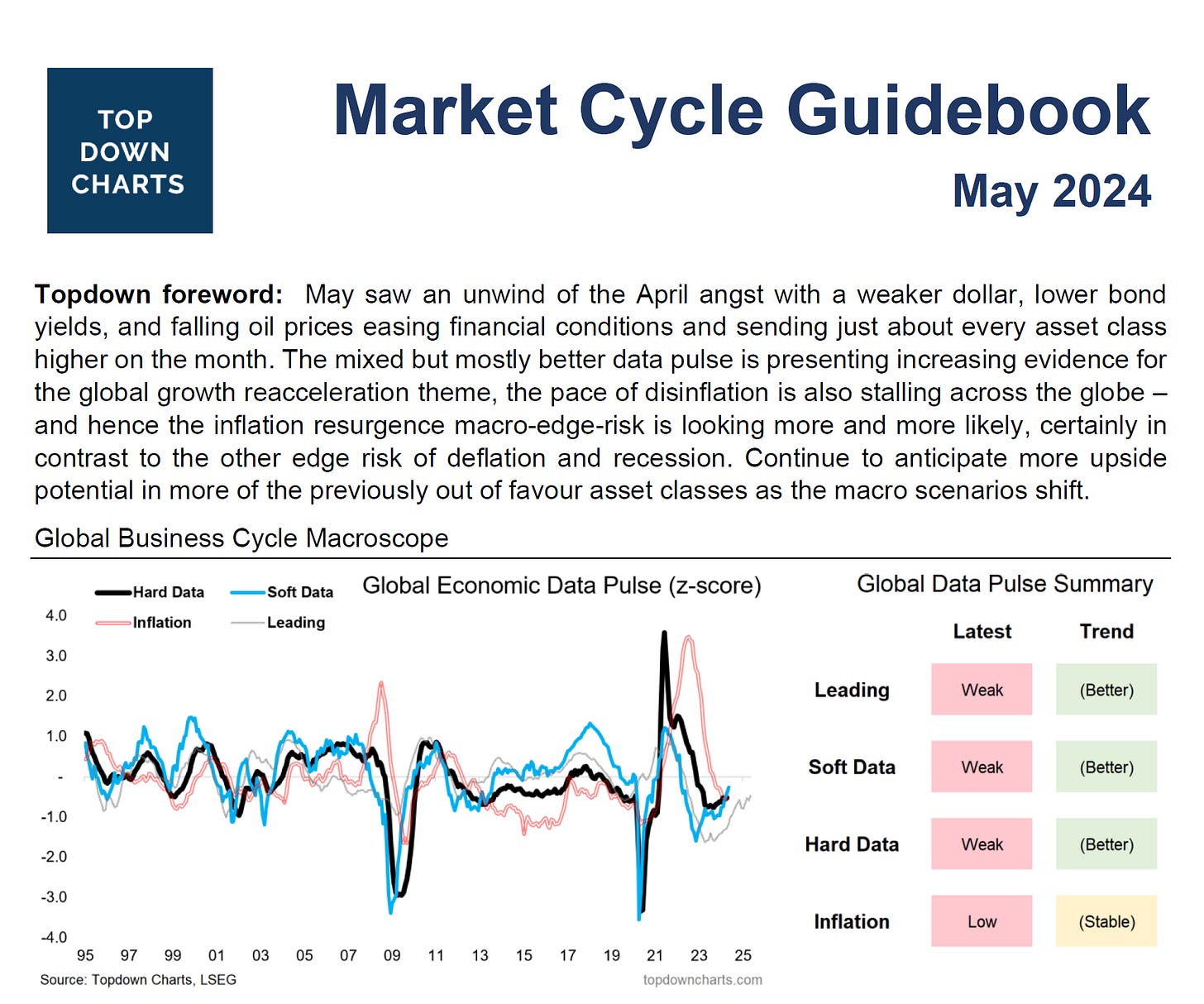

-The global growth pulse is turning up [see Global Cycle Map]

--soft data is trending distinctly “less bad”

--likewise the slowdown in hard data growth rates is turning around

--and even the leading indicators are turning up from previous warning signs

---hence the macro edge risk of reacceleration and inflation resurgence is credible

--investors need to think more about the idea of reacceleration

---(yet we continue to monitor for downside/recession risk signs)

-Central banks move into pause mode, and even pivot in places

--the Fed remains on pause, with a high hurdle for cuts or hikes

---others pivot: Sweden, Europe, Canada all cutting rates

---EM has collectively pivoted to rate cuts

----(notably China — making steps towards larger stimulus)

--the bulk of tightening is likely now behind us

---albeit the damage may already have been done (long + variable lags)

----and the global economy still faces a hurdle of higher rates

---thus the macro edge risk of deflation and recession is also there

--re-pivoting is also a risk, as some banks have moved back to hikes

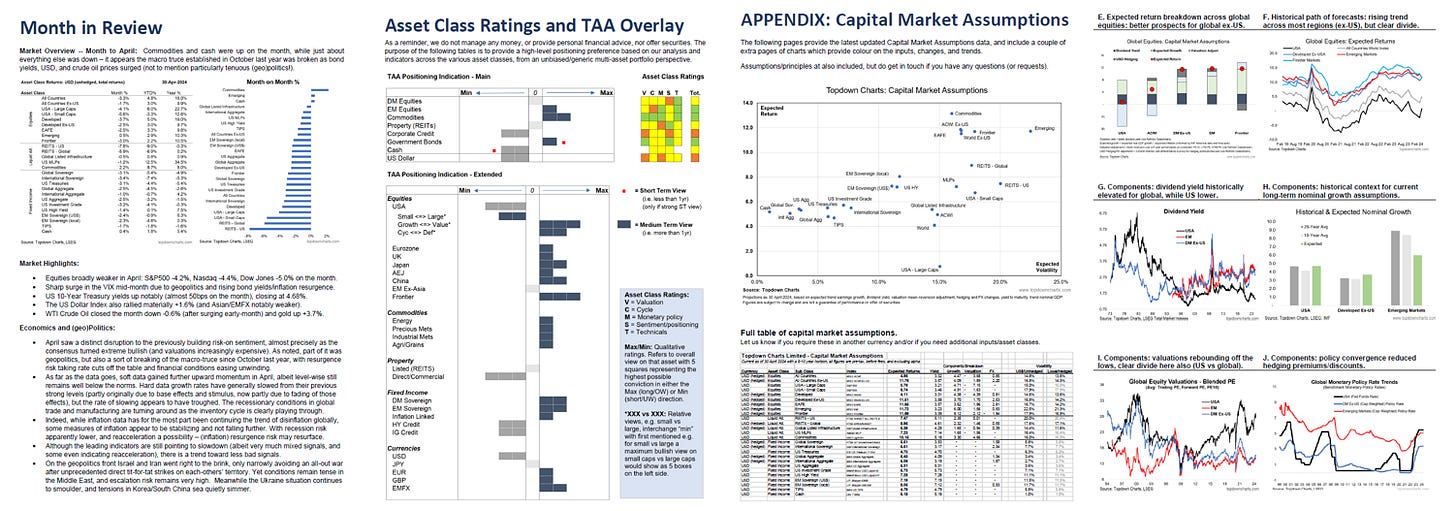

-Constructive on risk assets, but highly selective and wary of risks

--See Value in government bonds, commodities, defensive stocks, EM

-Tactically bullish on commodities (previous bearish)

--medium-term technical signals say risks skewed to the upside

--underinvestment means a new higher floor price across commodities

-the “macro edge risks” have very important and distinct market implications

--substantial opportunities (and risks) lie ahead…

Key features of the Market Cycle Guidebook:

-Instant overview of: global economic cycle, monetary policy, and valuations

-Market performance snapshot & commentary/highlights

-Summary views across asset classes (short and medium term); "cheat sheet"

-TAA/DAA guide visually mapping those views to recommended positioning

-Monthly updated Capital Market Assumptions

-And of course, over 70 charts illuminating the key medium-term drivers of risk and return across a global multi-asset universe

-Australia/New Zealand appendix (since we're down this part of the world!)

Click through to Learn More about this report and our services, or go ahead and subscribe now:

Corporate & Institutional Clients

Get in touch if you need information on other payment options (e.g. CSA payments and manual invoicing is also available if need), pricing for teams/multiple users, or if relevant you may request a trial, call, or due diligence documentation.

Otherwise, you can easily and simply self-onboard with the standard payment and subscription options (select either a single user or group subscription as relevant):

If you have any other questions or requests, simply get in contact.

Best regards,

Callum Thomas

Head of Research and Founder, Topdown Charts

About the Service:

The Topdown Charts Professional service caters to multi-asset portfolio managers and investment professionals. The service comprises a set of reports (2 weekly, 1 monthly, 1 quarterly) focused on identifying opportunities, risks, and emerging trends — along with personalized service to help make the portfolio managers' job easier. With the service we deliver a flow of investment ideas, risk management input, and meaningful macro insights to help you make better decisions and achieve your targets.

Our Head of Research and founder spent his career on the buy-side, and our reports reflect that perspective with a clear "so what?" focus rather than research for research sake. The reports are punchy and chart+fact focused, and are easy to read both in terms of speed and understanding: so clients often end up saving time and getting better insights. So if you're looking for a dedicated specialist service to help you deliver excellent returns for your clients, give us a try.