Global Cross Asset Market Monitor - 14 November 2022

Global market chart pack, comments/observations, market themes of note...

Hello and welcome to a new week - hope you have a good one!

The latest Global Cross Asset Market Monitor [Market Chart Pack] is attached below:

OBSERVATIONS - highlights and standouts in the market charts

1. Global Market Breadth: equities/commodities/EMFX/Treasuries breadth stronger, risk pricing and USD breath weaker. [pg 2-3]

2. Equities: equity markets considerably stronger, US equities up big on the week, Europe mostly positive, EM turning up, ASX breaking higher, bitcoin falling hard. [pg 4-9]

3. Global Equity Sectors: healthcare rolling over, discretionaries falling further, materials/industrials breaking higher, consumer staples falling. [pg 9]

4. Treasuries: Treasury yields significantly lower across the board, especially the 2-10 year range, 10Y back below 4%, real yields weakening. [pg 11]

5. Fixed Income: credit spreads narrowing, Europe HY falling, US/EU bank CDS easing further, EM CDS falling substantially. [pg 12-13]

6. FX: DXY falling significantly, EMFX turning up, most pairs substantially stronger against USD, Asian FX markedly higher. [pg 14-15]

7. Commodities: commodities index stronger, industrial metals rallying, silver pushing resistance, gold stronger, copper breaking higher, wheat/corn/coffee weaker. [pg 16-17]

Market themes: EMFX respite...

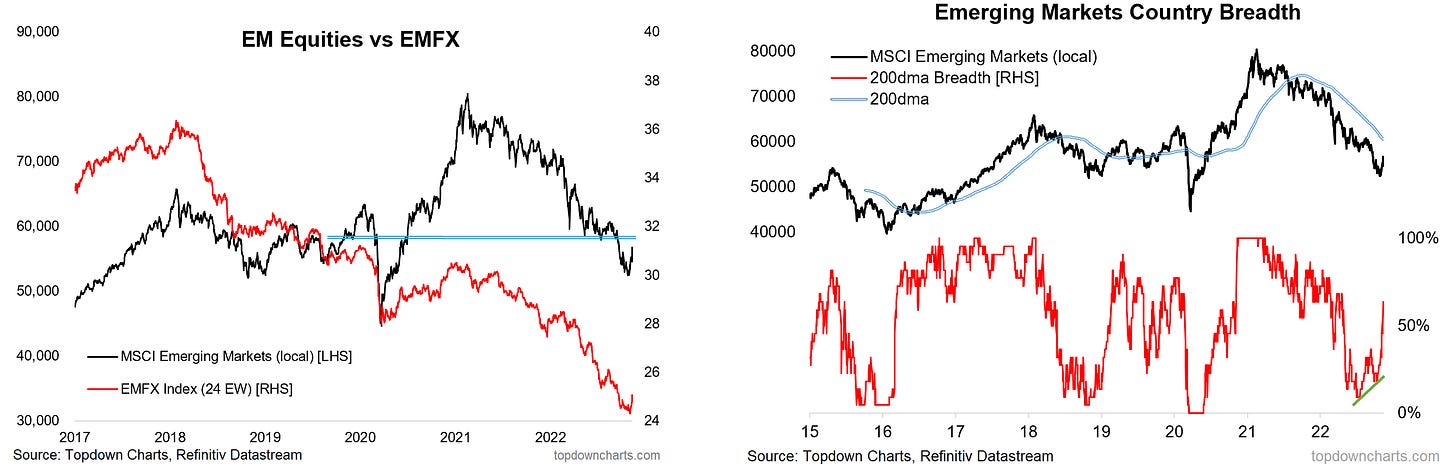

-The rebound/respite in EMFX lines up with and confirms the recent rebound in EM equities (which technically are looking interesting).

-The rebound in EMFX has been relatively widespread, and sharp (thanks to USD weakness)

--Asian FX saw the sharpest jump last week

---East Europe FX saw more steady gains over recent weeks (interesting given the group are a decent proxy/barometer for Ukr/geopolitics)

-Asian FX & Asian equity technicals look promising

--the optimistic take is that it represents a turning point

---the perhaps more realistic take is that it was a situation of oversold markets technically ready to rally finding a sequence of excuses

Market Theme Charts - EMFX Respite…

The respite/rebound in EMFX (thanks mostly to the drop in the US dollar - which I talked about in the latest report), is basically confirming the initial rebound in emerging market equities (which as a reminder from last week had put in a minor bullish divergence).

The rebound in EMFX has been relatively widespread across regions, albeit with Asian FX in particular having a sharp rebound. Intriguingly East Europe has had probably the most sustainable looking rally out of the 4, which is interesting in that this group did suffer from the Ukraine invasion spillovers -- and I would suspect that this group would be a good barometer of peace prospects, so something to keep an eye on as the conflict draws out.

Back on Asian FX, and Asian equities, although it is just one week, and essentially just a reaction to just the CPI, it is an interesting set of moves, and comes from fairly oversold conditions. It's also set against the backdrop of cheap valuations for Asian equities (and FX). So while I would treat the price action of last week with a bit of skepticism, it could end up a situation where price moves first, and fundamentals move later. But in the meantime, I would say the best assessment is we've got a bunch of overbought and oversold markets making sharp moves that they were technically ready to make and they just found a few excuses ("peak CPI", China covid easing speculation, US election uncertainty passing, emerging pressures for Ukraine peace (and Russian pullbacks/losses)).

And, in case you missed it -- the key conclusions from the latest Weekly Macro Themes report (click through for the pdf):

1. Inflation: Globally inflation remains high but peaking on some metrics; economic downdrafts likely drive disinflation in 2023, but still way too early to talk monetary easing (by the Fed).

2. Credit: Tighter bank lending standards, tighter financial conditions, and weakening economic outlook all suggest caution on credit.

3. US Dollar: Bearish US dollar given expensive valuations, overcrowded sentiment/positioning, and anticipated progressive removal of the previous powerful pillars of support.

4. AEJ Equities: The value story is falling into place for Asian equities, but the macro/cycle aspects are not playing along yet; also waiting/watching for more compelling China catalysts.

5. EM ex-Asia Equities: Also seeing a solid value setup for Emerging ex-Asia, but not enough to favour one over the other; rather = important evidence as part of the emerging picture for EM equities in general.

Best regards,

Callum Thomas

Head of Research | Topdown Charts Limited | www.topdowncharts.com

Mobile: (+64) 22 378 1552 | LinkedIn: https://www.linkedin.com/company/topdown-charts